Learning to drive is a big step, filled with excitement but also a few challenges—especially when it comes to insurance. As a parent, guardian, or friend guiding a learner driver, understanding the types of insurance available is key to finding a balance between coverage and cost. Choosing the right option can help you save money while ensuring the learner is properly insured.

Whether you’re considering adding a learner to your current policy or opting for a flexible, short-term insurance solution, this guide explores what you need to know about insuring a learner driver. We’ll cover average costs, options, and tips to find the most affordable solution without compromising on safety.

Key Considerations Before Insuring a Learner Driver

Several factors can influence the cost of insuring a learner driver, including their risk profile and the frequency of driving. Here’s what to keep in mind:

Cost Comparison

Insurance for learner drivers can be more expensive than standard policies, as learners are seen as high-risk drivers. Taking time to compare rates can reveal big savings.

Cost Comparison

Insurance for learner drivers can be more expensive than standard policies, as learners are seen as high-risk drivers. Taking time to compare rates can reveal big savings.

Impact on No Claims Bonus (NCB)

Adding a learner to your policy could affect your NCB if a claim is made while they’re driving. Some insurers offer options to protect your NCB, so check these out before making a decision.

Impact on No Claims Bonus (NCB)

Adding a learner to your policy could affect your NCB if a claim is made while they’re driving. Some insurers offer options to protect your NCB, so check these out before making a decision.

Coverage Levels

Learners can access coverage levels similar to experienced drivers, like third-party, fire and theft, or comprehensive. Make sure the policy meets all legal driving requirements.

Coverage Levels

Learners can access coverage levels similar to experienced drivers, like third-party, fire and theft, or comprehensive. Make sure the policy meets all legal driving requirements.

Driving Frequency

If the learner only drives occasionally, short-term insurance can be a more affordable option. For frequent practice, adding them to an annual policy may offer better value.

Driving Frequency

If the learner only drives occasionally, short-term insurance can be a more affordable option. For frequent practice, adding them to an annual policy may offer better value.

Car Type

The make and model of the vehicle also affects premiums. Cars in lower insurance groups are generally more affordable to insure, so consider this if you’re looking for cost savings.

Car Type

The make and model of the vehicle also affects premiums. Cars in lower insurance groups are generally more affordable to insure, so consider this if you’re looking for cost savings.

Why Is Valid Insurance Essential for Learner Drivers?

Having valid insurance is not only a legal requirement but also a practical necessity. Here’s why:

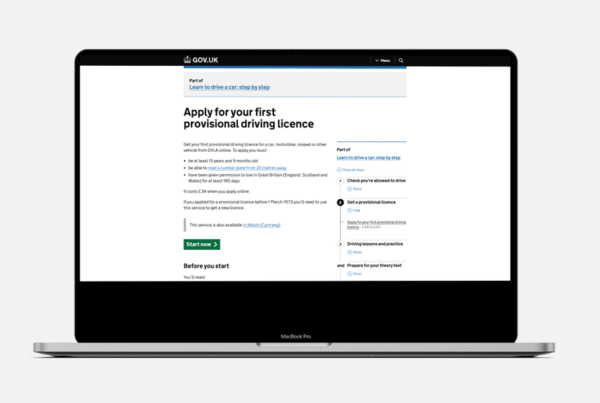

Legal Requirement

In the UK, all drivers—including learners—must have insurance that meets at least the minimum third-party cover. This ensures protection for others in case of an accident.

Legal Requirement

In the UK, all drivers—including learners—must have insurance that meets at least the minimum third-party cover. This ensures protection for others in case of an accident.

Financial Protection

Insurance shields the learner driver from potentially costly liabilities. Accidents happen, and without insurance, both the learner and car owner could face hefty repair bills.

Financial Protection

Insurance shields the learner driver from potentially costly liabilities. Accidents happen, and without insurance, both the learner and car owner could face hefty repair bills.

Peace Of Mind

Knowing the learner is insured offers reassurance for both the driver and supervisor. In the event of an accident, insurance will cover damages, easing any legal and financial concerns.

Peace Of Mind

Knowing the learner is insured offers reassurance for both the driver and supervisor. In the event of an accident, insurance will cover damages, easing any legal and financial concerns.

Options for Insuring a Learner on Your Car

Several options are available to insure a learner driver, each suited to different needs and driving habits. Here’s a breakdown of popular choices:

Adding a Learner to an Existing Policy

Adding a learner driver to an existing policy can be straightforward, especially if the learner plans to practice regularly. This option can come with increased premiums, as some insurers view learner drivers as higher risk. A potential downside is that any claims made during the learner’s driving sessions could impact your NCB.

Black Box Insurance

Black box, or telematics, insurance can encourage safer driving habits, as it uses a device to monitor driving behavior. This option is ideal for learners who drive cautiously, as safe driving can lower premiums. However, there may be restrictions, such as limits on night driving or a cap on mileage.

Short-Term Learner Driver Insurance

For occasional practice sessions or upcoming tests, short-term learner driver insurance from providers like Collingwood can be a flexible and cost-effective option. With Collingwood, you can arrange coverage from as little as 28 days to up to 12 months, allowing learners to practice without impacting the car owner’s No Claims Bonus. This separate policy also provides peace of mind, as it won’t interfere with any existing insurance arrangements.

Annual Learner Driver Insurance

For regular practice over an extended period, annual learner driver insurance may be the most economical choice. Although the upfront cost can be higher, this option provides consistent coverage throughout the year. Collingwood’s annual policies, for example, start at competitive daily rates and allow learners to practice in a family member’s car without affecting their NCB.

How Much Does Learner Driver Insurance Cost?

Short Term

Short-term learner driver insurance is ideal for flexible coverage. With Collingwood, policies start from around 78p per day*, providing learners with affordable access to driving practice without a long-term commitment. This setup allows learners to practice driving in their own car or that of a family member, building skills and confidence without affecting the car owner’s primary insurance.

Annual Policies

An annual policy offers cost savings for learners who plan to practice regularly, averaging out to a lower monthly cost. For instance, Collingwood offers policies that start as low as 72p per day*, covering a 12-month period. An annual learner driver policy enables learners to practice frequently, helping them prepare for their driving test while benefiting from comprehensive coverage.

The cost of insuring a learner driver varies based on factors like coverage, frequency, and type of insurance. By understanding these options—whether it’s adding a learner to an existing policy, choosing short-term coverage, or going for an annual learner insurance policy—you can make an informed choice that meets both budget and safety needs. Providers like Collingwood offer versatile learner driver insurance solutions tailored to different needs, ensuring you can find the right fit.

As your learner gains confidence behind the wheel, the right insurance not only provides safety but also offers the support needed for a successful journey to becoming a licensed driver.

*Prices correct as of 07/05/2024